Why Bitcoin dropped and why it stopped

Plus early signs of a possible top in the market for NFTs.

In this issue:

Bitcoin in the face of maximum pain

NFTs may be nearing the top

Bitcoin in the face of maximum pain

Bitcoin reached its last all time high was on March 13th at ~$61k after which it dropped ~15% to a recent low of ~$52k on March 25th. As of writing the price has recovered to ~$55k These sorts of drops happen periodically in Bitcoin and they don’t necessarily always have "reasons" per se, but in this case there are some things that were probably contributing factors.

One factor is that March is the end of the fiscal quarter, which means institutional funds are doing their quarterly rebalancing. A lot of funds have rules/restrictions about how they allocate their investments - so at the end of every quarter they buy/sell different investments as needed to bring their portfolio back to the desired ratio of asset types. Bitcoin’s price almost doubled this quarter (here is an excellent newsletter about it) so a lot of the new institutional holders are likely obligated to sell a portion of their investment to keep Bitcoin from overwhelming the rest of their portfolio.

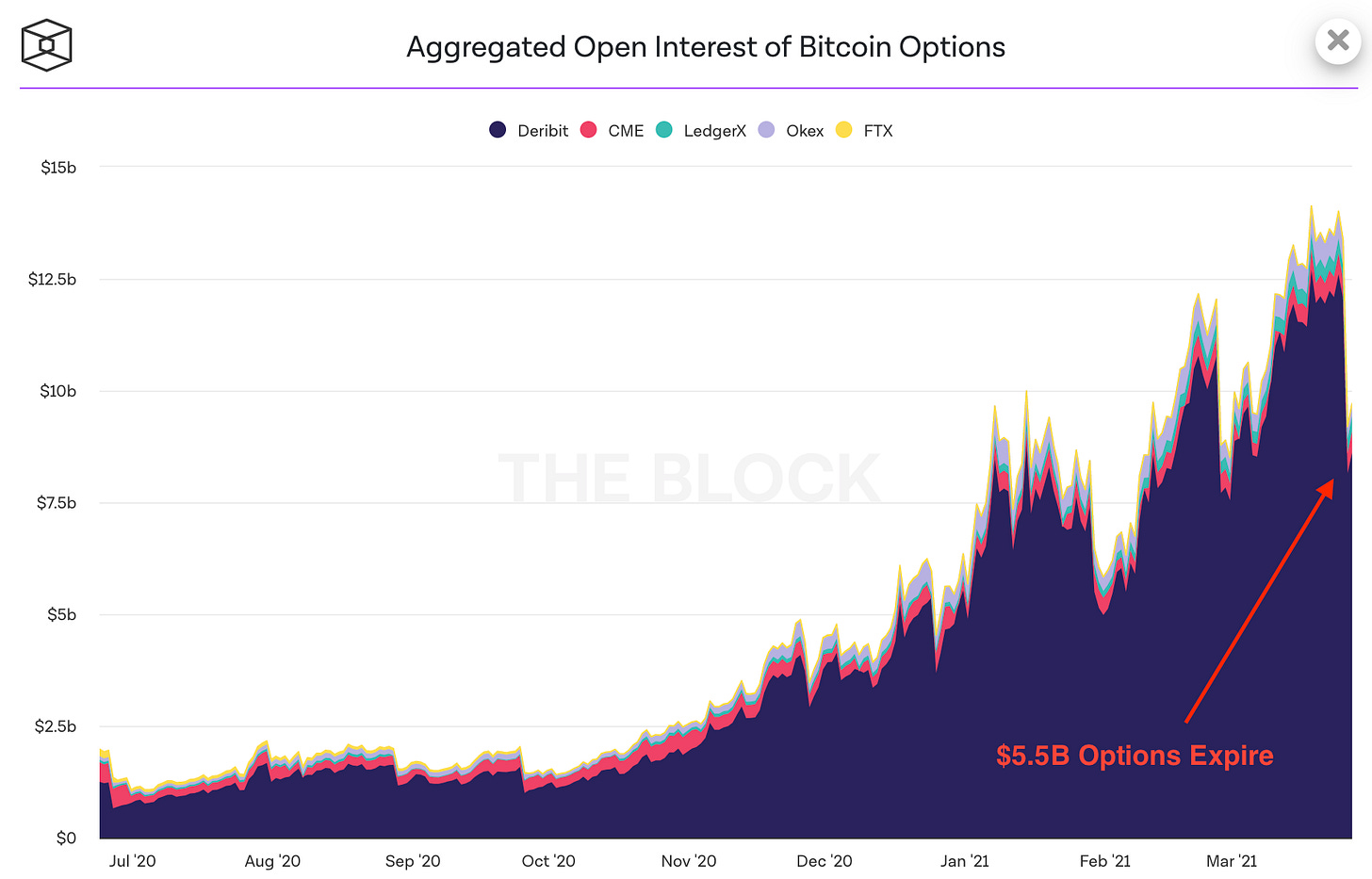

Another factor is likely Bitcoin option traders. Demand for Bitcoin options has grown ~7x in the last year, mostly on Deribit:

The abrupt drop on the far right side of the graph is the record number of options that expired on Friday, roughly ~$5.5B worth. Options on Deribit are cash-settled, which means no bitcoin ever changes hands. Most options expire worthless (like an option to buy Bitcoin for more than the current price or to sell it for less) but when an option expires in profit the writer of the option pays the owner in USD.

As an option writer I prefer when options expire worthless - there is less paperwork and I get to keep my dollars, which I am fond of. So when I sell call options (the option to buy) I want the price to go down, and when I sell put options (the option to sell) I want the price to go up. That means open "in the money" options exert a kind of magnetic drag on the price of the underlying asset: profitable call options drag the price down and profitable pull options drag the price up. That drag intensifies the closer the option is to expiring and (if still profitable) being exercised.

The collective tug-of-war between all options drags the underlying asset towards a price where the maximum number of options expire worthless - a pattern somewhat melodramatically known as the theory of maximum pain. So the record ~$5.5B of options that closed on Friday were accompanied by a correspondingly large drag on the price towards the point of maximum pain - which for the options expiring on Friday was ~$40k.

This was the largest options-driven headwind in Bitcoin’s history and it passed without bringing the price within $10k of the point of maximum pain. The previous record for option expirations was ~$4B at the end of January, after which the Bitcoin price rose by ~80%. If option expirations were actually one of the primary drivers of the recent downturn, we may be ready to start moving back up again.

Weakness and froth in the NFT market

Ed. Note: Still confused about NFTs? I recommend starting here.

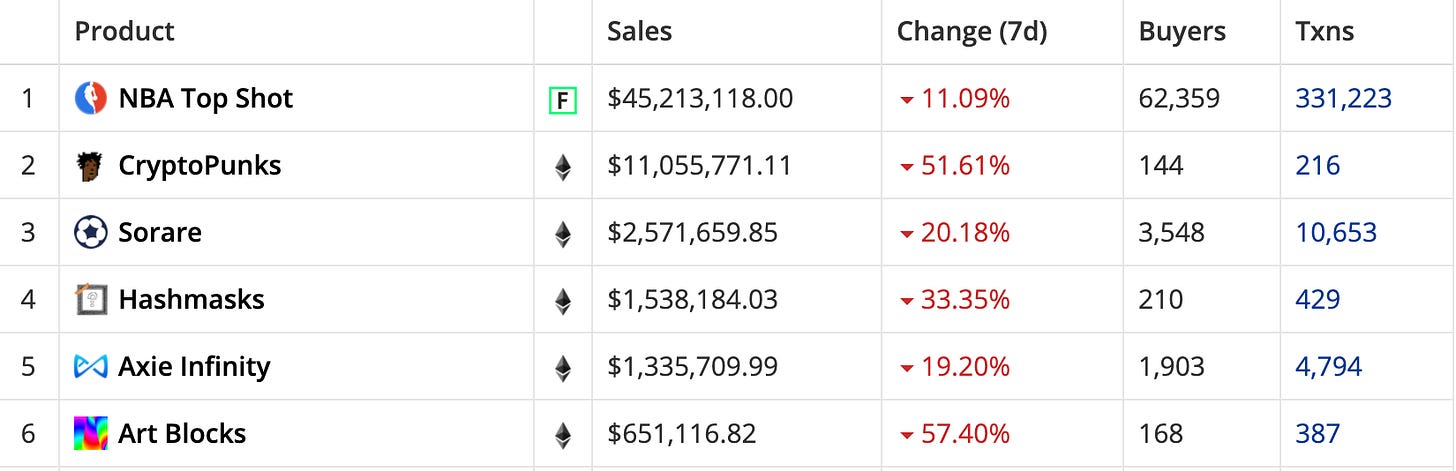

The market for non-fungible tokens (NFTs) may be starting to run out of momentum. Weekly sales volume for top projects have dropped between ~11-57%. The two largest projects (NBA TopShots and CryptoPunks) are seeing sharp downturns in price:

At the same time NFT-awareness is continuing to surge in mainstream culture. John Cleese is now selling an NFT of the Brooklyn Bridge. Gorillaz are celebrating the 20 year anniversary of their debut album with a collection of NFTs. On Saturday SNL offered this surprisingly accurate (as far as it goes, anyway) explanation of NFTs to their audience:

I assume it is only a matter of time before NBC sells an NFT of that skit. As we’ve talked about before I anticipate a painful crash in the market for NFTs sometime in the next six months to a year. I don’t know if this is the top yet but it certainly feels frothy. It reminds me of the NYTimes article "Everyone is getting hilariously rich and you’re not" - which hit the presses in January of 2018 and marked the start of a three year bear market.

Other things happening right now:

A nice analogy for how government power tends to line up behind the choices that market power has already made. If enough people, politicians and businesses have already personally invested in Bitcoin, governments may find themselves co-opted before they even have a chance to mount meaningful opposition.

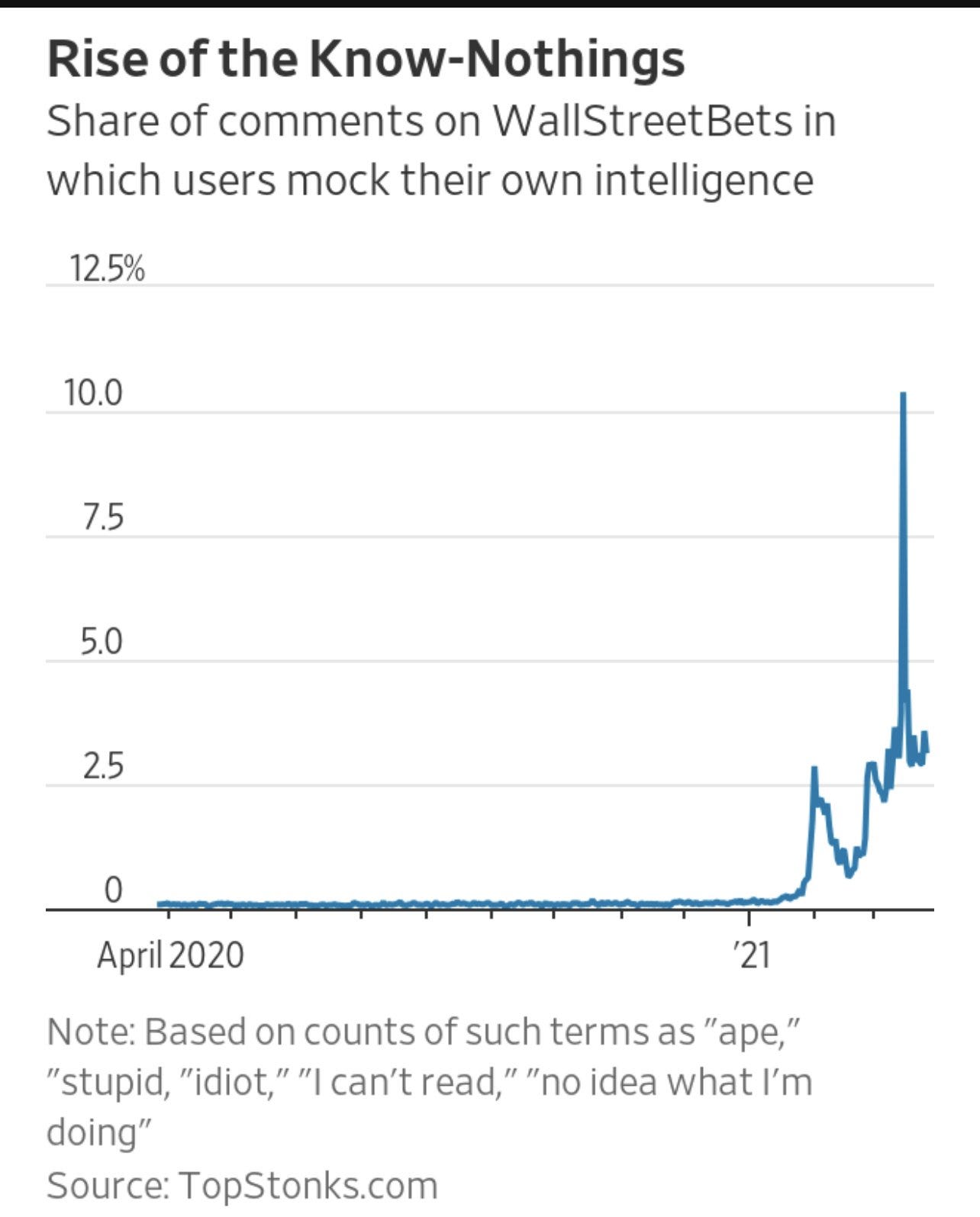

I’m not sure what this means but I’m certain it means something.