Korean Bitcoin is just better, that’s all

Plus Bitcoin is a $1 Trillion asset class and the Prime Minister of Singapore politely requests that you not steal his identity.

In this issue:

Korean Bitcoin is just better, that’s all

Bitcoin is a $1 Trillion asset class

Korean Bitcoin is just better that’s all

At time of writing Bitcoin is trading on the South Korean exchange Bithumb for ~74.5M won (i.e. ~$66.3k USD) - roughly ~13% higher than the Bitcoin price on US exchanges. Higher prices for Bitcoin in Korea are actually relatively common - in 2018 Korean prices spiked as much as 55% higher than the global baseline.

Editor’s Note: The phenomena of higher South Korean prices for Bitcoin is often called the Kimchi Premium but I find that term condescending so I don’t use it.

The fact that Bitcoin commands different prices in different markets is interesting, because Bitcoin itself does not have a location and is unaware of national borders. It is equally easy to send Bitcoin to an exchange in South Korea or Hong Kong or the United States - Bitcoin does not care. So Bitcoin itself flows freely around the globe - but the fiat pairs that it trades against do not.

The reason that Korean Bitcoin prices tend to be higher than other markets is because South Korea instituted a series of capital controls in 2010 that significantly restrict the movement of fiat wealth in and out of the country. In an unrestricted market South Korean cryptocurrency firms would arbitrage the premium away by buying bitcoin abroad and then selling it locally - but it is actually quite difficult to move money out of South Korea in order to buy the Bitcoin. Since it is difficult to import new bitcoin the bitcoin that is available for sale trades at a significant premium.

It might feel like bitcoin that is in South Korea is worth more - but Bitcoin doesn’t have a location. All bitcoin is equally in South Korea or not in South Korea depending on how you think about it. So it can’t be the case that bitcoin in South Korea is worth more because there is no bitcoin in South Korea. So Korean Bitcoin isn’t actually better - what is actually happening is that the won trapped in South Korea is willing to pay a premium to escape. Bitcoin is the escape hatch.

Bitcoin is a $1 Trillion asset class

Bitcoin traded last week between the (relatively) narrow band of ~$57-60k, meaning that it spent the entire week trading above a $1 Trillion market cap. That makes Bitcoin the 14th most valuable currency in the world, just behind the Swiss Franc. If Bitcoin were a company it would be the sixth most valuable company in the world, worth more than Facebook but less than Alphabet (i.e. Google).

There seems to be decent evidence of support at these levels. The high trade volumes recently imply that there are a lot of interested buyers at these prices, so it probably isn’t a fluke that Bitcoin is trading here. Glassnode watches these support levels on chain and observes lots of buying activity at around $54k and $58k (the two taller bars highlighted on the right side of the graph):

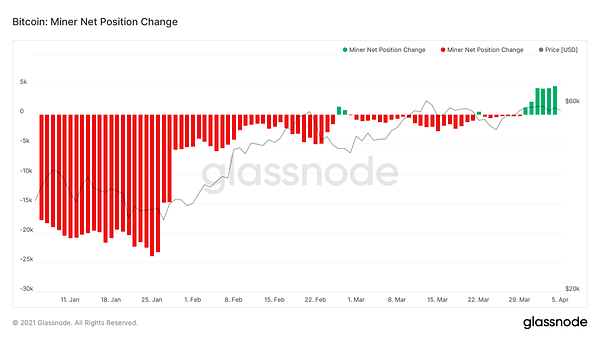

There are also signs that investors are getting more confident. Bitcoin miners have switched back to accumulating Bitcoin rather than liquidating:

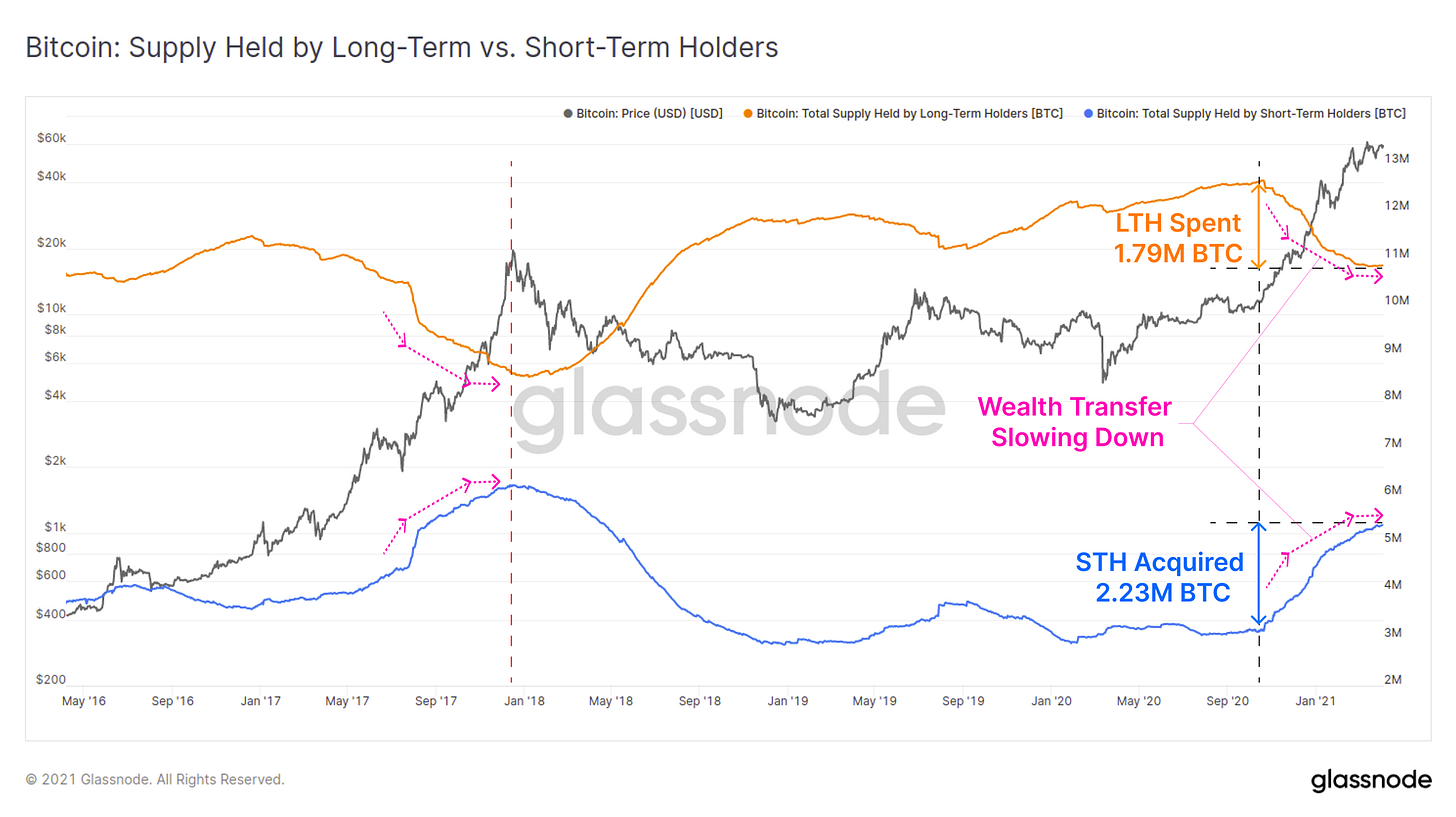

The total bitcoin supply held by long term holders (the orange line in the graph below) is stabilizing, and the growth in total supply held by short term holders (the blue line) is slowing down. That suggests that long term holders (like miners) are expecting more growth in the short to medium term.

Taken altogether it seems like the market has internalized these prices as normal and perhaps even undervalued. In other words:

Other things happening right now:

We talked last issue about the upcoming Coinbase IPO. Here is an excellent thread from Ellie Frost about their upcoming earning’s report and why it is likely to cause another hype cycle. Regular earnings reports from a highly profitable public company will make the entire cryptocurrency market look more legitimate to traditional Wall St investors.

Remember BitClout, the startup that managed to offend every major influencer in crypto at the same time by using their name and likeness to sell tokens without permission? Apparently one of the likenesses they used without permission was the actual Prime Minister of Singapore. Turns out, he didn’t care for that! Must be a cultural thing.

The saturation of Bitcoin into professional sports continues:

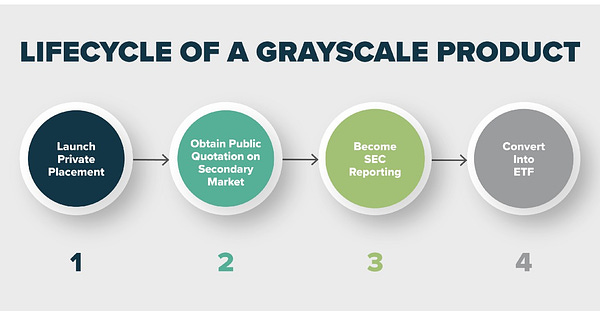

Grayscale (the company behind GBTC) formally announced their intentions to transition into an exchange-traded fund (ETF). As we’ve talked about the need for them to make this transition is obvious - but the fact that they are now publicly discussing plans probably means they have a greater confidence of reaching regulatory approval relatively soon. I’m guessing within the next six months.

Kevin O’Leary says he will only buy bitcoin mined with clean energy. I can only assume he is also committing to only using dollars with no trace of cocaine and only selling products made with renewable materials. Otherwise people might get the impression this is empty posturing.