Editor's Note: This kills the coin ...?

Notes on my ten doomsday prophecies for Bitcoin

Hey Friends -

As a companion to This kills the coin I wanted to share a few thoughts about the ten doomsday scenarios I outlined and how concerned I think reasonable people should be about them. So here is the same list of fears but with a bit more analysis than fit into the conceit of the original post. Enjoy!

KF

10. Governments become worthy of our trust

9. Bitcoin users lose all hope

There have been and will be again times when large portions of Bitcoin investors will suddenly lose faith and seek to exit the system — but for a crash like that to be fatal to the network it needs to be universal. As long as there are any remaining users who still value and believe in the network they will set a price floor that Bitcoin will not drop below. In that sense the ideological core of users who are motivated beyond just reasons of profit provide an additional line of defense against a sudden loss of confidence. Threats that require universal collective action aren’t very concerning because if universal collective action were easy we wouldn’t need a system like Bitcoin in the first place. This is unlikely to kill the coin.

8. Surprise! There is a bug. 🙀

Severe bugs in Bitcoin’s logic have been discovered in the past and my guess is that we will discover more in the future. Taken at face value they often seem fatal to the system (e.g. one allowed the creation of infinite bitcoin) but in practice they actually have not been very damaging so far because the actual Schelling Point for Bitcoin is not the Bitcoin core software, but instead the underlying social agreement that Bitcoin is meant to enforce.

When bugs straightforwardly deviate from the intended social consensus they are (relatively) easy to deal with: if we find out Bitcoin Core (the software that runs Bitcoin nodes) technically contains an obscure way to create infinite new Bitcoin everyone knows that is a bug and those new Bitcoin are invalid. The software that runs Bitcoin is an execution detail, not an existential one.

Less likely but much more concerning is the possibility of (as yet unknown) bugs in the idea of Nakamoto consensus itself. If the problem is not a faulty line of code but instead a newly discovered exploit in the underlying social consensus, fixing the issue may not be a matter of writing code so much as discovering new math. Depending on the exploit in question there might not be a solution. Math is tricky, it can take decades to discover flaws in a proof or find a new solution when an old one has been invalidated. This could definitely kill the coin.

7. They built a better mousetrap

Bitcoin is often misunderstood as a technical innovation with a social component when it is better thought of as a social innovation with a technical component. The blockchain itself is a weird, contorted parlour trick that achieves a useful social outcome — not a useful structure in and of itself. Bitcoin is not interesting because it has a blockchain, blockchains are interesting because they enable Bitcoin. So it’s difficult to out-innovate Bitcoin because innovation is not really at the heart of what makes it valuable.

That said, I also confidently told people that Bitcoin was impossible — so I have adopted a healthy skepticism about how impossible impossible things really are. I am confident that proof-of-stake is not a solution to anything and that Ethereum is a fundamentally flawed approach. But I am not confident that every alternative to Bitcoin will be a failure. I keep my eyes on the horizon. This could definitely kill the coin.

6. Never meet your maker

Satoshi Nakamoto is (or was?) a genius who saw all of this coming years and years before anyone else. He understood deeply the negative consequences were of a lingering founder for a supposedly leaderless network. He has resisted billions of dollars worth of temptation by leaving his stash untouched. So we know he is incredibly smart, incredibly disciplined and incredibly prescient. I don’t think we will ever find him. That said if we did discover who he was he would inevitably disappoint in comparison to the myth he left behind. I don’t think this particular threat is very likely or necessarily fatal, but it would be a bummer. This mostly disappoints the coin.

5. Better an absent prophet

The idea that Satoshi (after having resisted billions of dollars and painstakingly preserved his privacy for years) would suddenly become tempted by the opportunity to cash his legacy in for status is bonkers to me — but the idea that a con artist like Craig Wright could present convincing enough evidence to hijack Satoshi’s legacy and use it to build a cult of personality is alarmingly plausible. We have to be careful not to deify Satoshi so as not to leave behind a shell of implied authority that can be leveraged by attackers. This kills the coin and Weekend-at-Bernie’s the body.

4. Trust us, we verified

The original Bitcoin whitepaper is only 8 pages long and the only new word it contains is Bitcoin. The simplicity of Bitcoin’s design is important not just for aesthetic elegance but because the more people who understand how Bitcoin works the more decentralized the network can be. A slow accumulation of technical complexity is actually a subtle but serious threat to the long-term health of the network. Consider a privacy upgrade that makes it harder to verify supply or a Layer-2 whose operations are rooted in zk-SNARKS — the less accessible the logic of Bitcoin is the more susceptible it is to capture by an expert class. If the liturgy becomes latin, the laity will know their place. Hoc occidit denarium.

3. Governments … attack! 🙀

China is already engaged in early action in trying to eradicate Bitcoin from their country, if not destroy it entirely — so it seems likely that the question is not so much if governments will attack Bitcoin as when and how. I personally think that America is unlikely to take decisive action to destroy Bitcoin. The current iteration of America is not well positioned to take any decisive actions and at this point Bitcoin is large enough to have become a meaningful lobbying presence in its own right. I also think the dynamic of crypto benefits the USD for decades to come, so by the time Bitcoin and American power truly come into conflict even more American wealth will have become intertwined with the Bitcoin network. That said if world governments were able to unite and sustain a focused attack on the network it would not be very expensive (by world government standards) to suppress it. This kills the coin.

2. Decentralization works but we can’t afford it

A lot of crypto pundits don’t want to admit it but decentralization is inherently expensive. That will remain true regardless of what Layer-2 innovations are developed as we continue to innovate — blockspace will always be expensive. We are still discovering what 'expensive' will actually mean in practice as networks start to attract usage and experience congestion. If expensive turns out to mean only accessible to businesses and wealthy individuals that’s probably still decentralized enough to deliver the basic value proposition of Bitcoin. If expensive turns out to mean only accessible to nation states and central banks the result will be a system no better than the one it is replacing. This kills [the spirit of] the coin.

1. Decentralization works but no one will pay for it

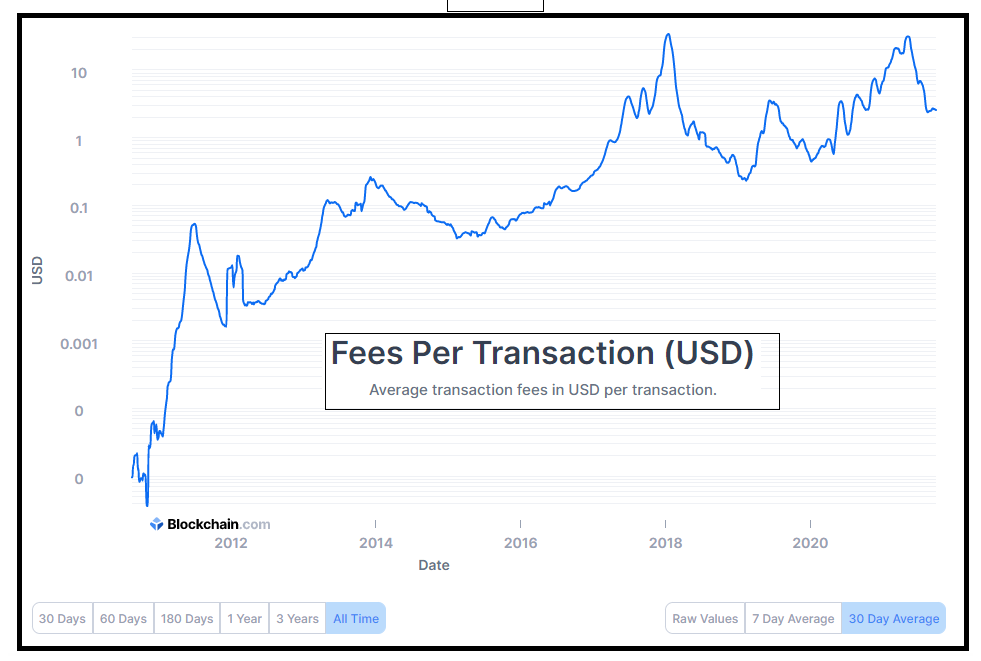

Just because something is valuable doesn’t mean anyone will pay for it. Lots of valuable public goods are neglected because market failures prevent price discovery. Eventually when block rewards have run out miners will need a constant stream of users outbidding each other for limited blockspace to generate revenue. So far the trend in Bitcoin fees is positive but fairly weak:

Future efficiency innovations may require blocksize to actually be reduced in the future to maintain fee pressure — but such a move would be difficult to build consensus around since anyone relying on low fees would be opposed. The era of the block reward is one of subsidized transactions — businesses may become addicted to the subsidy or may not be viable at all without it. After 140 years all 21M Bitcoin will have been mined and the block reward subsidy will have worn off. We have until then to wean ourselves off our addiction. This could easily kill the coin.

Orange pill a no-coiner! Give them a subscription to Something Interesting this year.