Deep dive: Ethereum is a psychedelic garden

A long-form, much requested exploration of Ethereum - what it is, how it relates to Bitcoin and what you should consider before investing.

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

What is Ethereum?

(reader submitted by many people - sorry it took so long!)What does Ethereum enable?

What are the criticisms?

What is maximalism?

First, a slice of humble pie

Here is a lightly abridged transcript of an actual conversation my brother and I had back in 2014, when Ethereum was first announced and the pre-sale had begun:

Jul 23, 2014, 12:02 PM Bro: You looking in to Ethereum at all?

Jul 23, 2014, 12:03 PM Me: Curious but very skeptical

Jul 23, 2014, 12:03 PM Me: Pre mines wig me out

Jul 23, 2014, 12:10 PM Bro: The concept is intriguing to me. There are 13 days between now and the next price increase for the presale.

Jul 23, 2014, 1:41 PM Bro: It might be cool to grab ~500 ETH and see what happens

Jul 23, 2014, 2:00 PM Me: Color me skeptical. They haven't defined the mining process yet

Jul 23, 2014, 2:00 PM Me: So there is no way to know scarcity

Jul 23, 2014, 2:01 PM Me: So ... I would caution against.

The closing price for Bitcoin that day was $601/btc and Ethereum was being offered for 5000 eth/btc, meaning the stake my brother was thinking about buying would have been a roughly ~$60 investment, now worth ~$700,000 at time of writing. Sorry, bro?

The reason I start here is because I remain skeptical of Ethereum and I’ll explain some of the reasons that I still am below, but I have not been very good at predicting how the market for ether will move. Worth remembering that nobody in this space has a very good track record for predicting the future. As always I am not a financial advisor and this is not financial advice.

What is Ethereum?

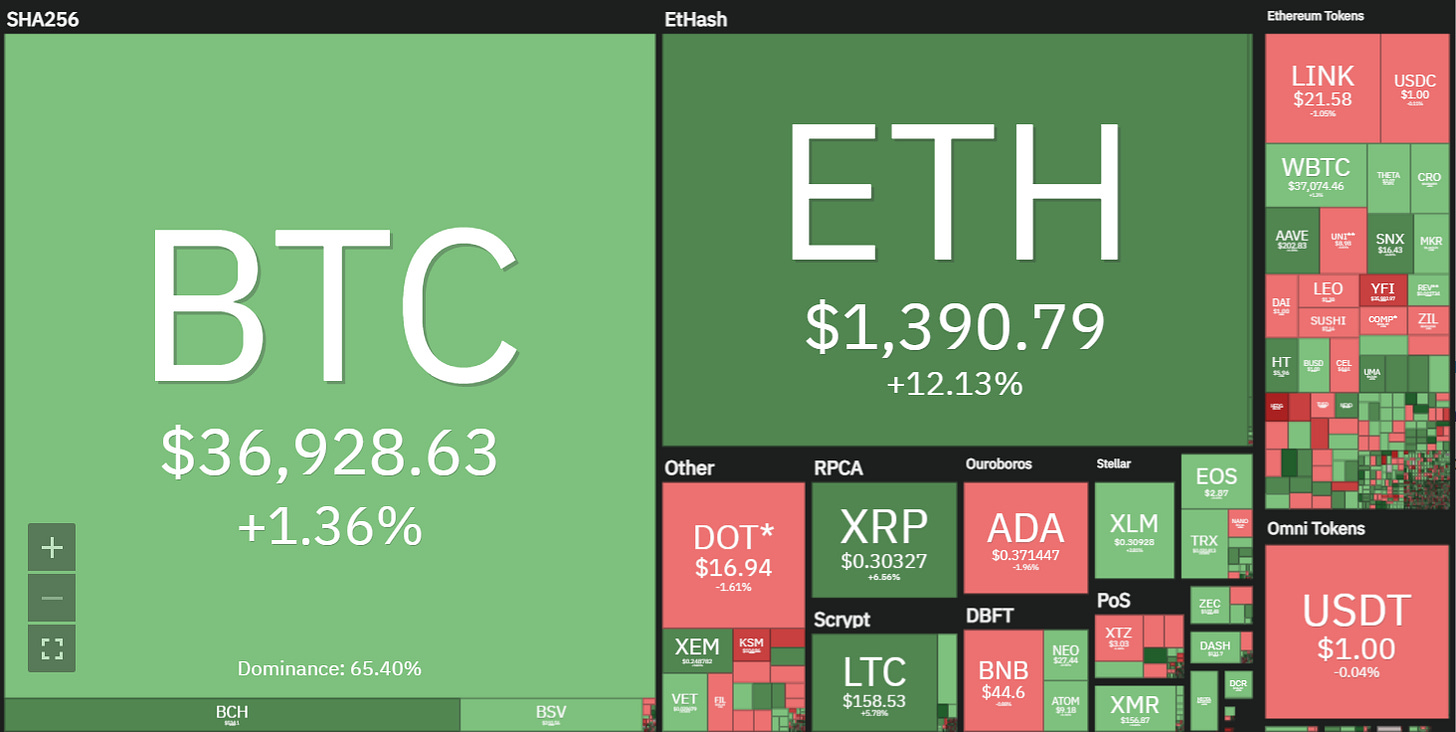

In the time since Bitcoin’s launch the blockchain technology that powers it has been tweaked/repurposed and launched to create literally thousands of competing cryptocurrencies often referred to as 'altcoins'. The largest and most significant of these Bitcoin competitors is Ethereum. This graphic gives you a sense of scale by comparing market caps: BTC represents just under ~66% of the cryptocurrency market at the moment, ETH represents ~15%. The patchwork of smaller tokens above USDT are tokens that are built on top of Ethereum - more on that later. You can see how Ethereum is the only cryptocurrency that competes with Bitcoin at scale:

Different altcoins have different stories for how they will compete with Bitcoin, most of which have proven unconvincing to the market. Ethereum’s intention is to be the ideal platform for smart contracts. A smart contract is a bit of code that captures the terms of an agreement between two parties and automatically enforces that agreement directly on the blockchain. You can really only do two things with Bitcoin, keep them or give them to someone else. But Ethereum is turing-complete which more-or-less means that you can run any program that you can conceive of directly on the Ethereum blockchain - assuming you can pay the fees.

There are some other important differences between Bitcoin and Ethereum. For one, the founder of Bitcoin (Satoshi Nakamoto) is unknown and received no special advantages in Bitcoin for being the founder. Ethereum’s founder (Vitalik Buterin) is both known and still very much active in the space and ~20% of the initial ether created were set aside for Vitalik, early team members and the Ethereum Foundation.

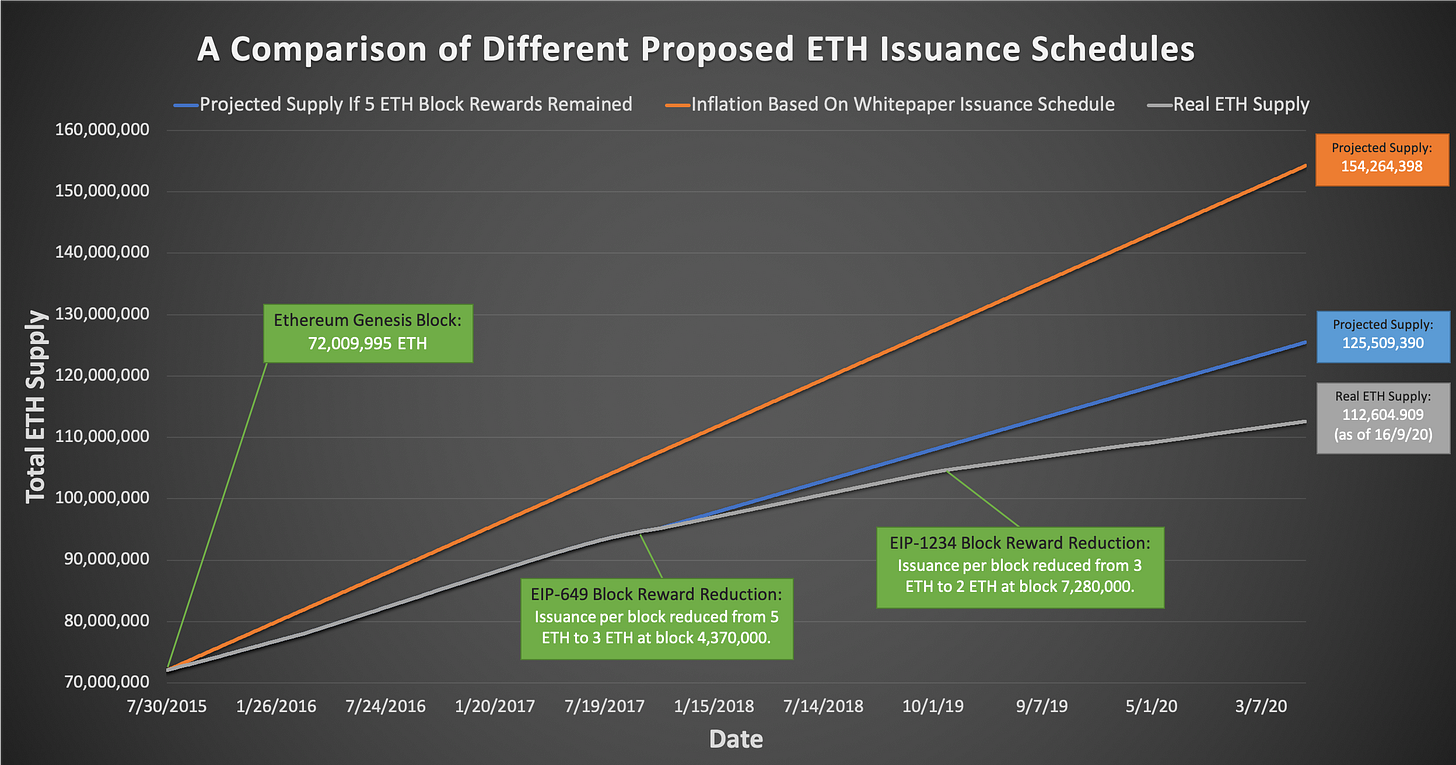

Bitcoin’s 21M supply schedule was established at launch and is generally viewed as sacrosanct by the community. Ethereum’s supply schedule has changed a number of times and has more changes coming in a planned series of sweeping updates to the entire system known collectively as ETH2.0. So it’s easy to know how many bitcoin there will be at any given time but the same is not necessarily true of ether. On the other hand, most of the major changes so far have actually reduced issuance:

As a general rule Ethereum is evolving much more quickly than Bitcoin. Some people regard that as an asset (because it can add functionality and enable new uses) and some regard it as a vulnerability (because it might introduce bugs or be captured by special interests). Bitcoin is built on a stodgy, pessimistic, don’t-break-it economic philosophy. Ethereum is built on a lively, optimistic, we-can-build-it techno-utopian philosophy. The communities have a different aesthetic:

What does Ethereum enable?

The inherent flexibility of Ethereum makes it much easier to experiment, which has turned Ethereum into a psychedelic garden of weird financial products and prototypes. This Cambrian explosion has resulted in a lot of very interesting new things being built on top of Ethereum. The patchwork of tiles above USDT in the heatmap above shows all the different financial products launched on top of the Ethereum platform - collectively worth almost as much as Ethereum itself.

One reason for that is the ERC-20 protocol, which standardized the basic functions of tokens launched on Ethereum and made it easy for exchanges to support the whole ecosystem with one upgrade rather than needing to do work for every new token. Once the ERC-20 protocol was popularized it was much easier to launch a new token on Ethereum - you could piggyback on the Ethereum blockchain without having to bootstrap your own mining ecosystem and you automatically got exchange support so it was easy to speculate on your new token.

In 2017 and 2018 there was a surge of new cryptocurrencies launched this way, often sold in "Initial Coin Offerings" (ICOs) that collectively raised ~$14B in funds mostly from small investors. These days the ICO has fallen out of fashion as a fundraising technique and the SEC has made it clear that it does not sidestep securities regulation about raising funds from American investors. We don’t see many ICOs anymore, but they underwrote much of the Ethereum ecosystem at the time.

Non-fungible Tokens (NFTs) are another thriving area of experimentation on Ethereum. NFTs are cryptocurrencies where each unit of the currency represents something unique rather than an interchangable share of the total ecosystem. They can be used to represent digital collectibles or increasingly prominently art. They can be one of the harder parts of the crypto space to wrap your head around, but they are undeniably growing - I mentioned in a recent issue how a 24x24 pixel CryptoPunk sold for ~$170k worth of ether. There have been NFTs auctioned off by Grimes, deadmau5, MF Doom and Justin Roiland among many others. You can even buy officially licensed moments in NBA history:

The ecosystem only gets more complex and intertwined from there. Fans often refer to the broad family of financial products being built on Ethereum as DeFi, short for decentralized finance. The basic aim of the developers in the space is to create decentralized counterparts to traditional financial products by building them into smart contracts on top of Ethereum. There are collateralized loans, prediction markets, yield-seeking funds and decentralized exchanges. If you can imagine a trader at Goldman Sachs constructing a financial Rube Goldberg machine, there’s probably a DeFi dev trying to do the same thing with a token named after a food they recently ate. There are also literal meme factories.

Anyway, there are a lot of things built on DeFi. All those things run on top of Ethereum, which means you need to buy ether in order to make them work. The bull case for ether is that whatever the next killer app that disrupts the financial market turns out to be, it will be built on Ethereum.

What are the criticisms?

The most foundational criticism of Ethereum is the downside of its greatest strength: flexibility makes it mutable. Bitcoin’s central promise is that it will not change because it cannot change. Ethereum’s promise is that it is changing in ways that are going make it better. Getting better is great, but it does raise some thorny philosophical questions, such as: who gets to decide what changes?

This isn’t a hypothetical concern. In July of 2016 several of the Ethereum founders began a project called simply The DAO, or decentralized autonomous organization. The idea was that it would be a headless VC fund where all investors voted on all potential investments. The experiment ended abruptly when an attacker figured out a clever way to siphon off ~3.6M ether from the smart contract (~$50M at the time). Afterwards Ethereum itself decided to rewrite its history to return the stolen ether. It was hugely controversial since Ethereum was often marketed at the time with the slogan "Code is Law."

The next year there was a catastrophic bug in a major Ethereum wallet called Parity that permanently locked ~$280M worth of user funds. Parity called for another fork to rescue the lost user funds. That time code turned out to be law. Was the difference that the community no longer had appetite for controversial interventions? Or was the difference that fewer Ethereum Foundation devs had personally lost money in the Parity bug than the DAO hack? Tough to say.

Another simple question you might ask when deciding whether to invest is how much ether will there be? The answer is that the ether supply is uncapped so we don’t know. Also we don’t know because the switch to ETH2.0 will radically change issuance but we’re not sure how yet. The general belief in the Ethereum community is that the devs (or perhaps the community?) will make the right choices about these parameters as the project develops. But if we trust the devs to make the right choices managing the Ethereum supply, why would we not trust central banks to correctly manage the supply of fiat currencies?

A blockchain is a ridiculously inefficient Rube Goldberg contraption whose only purpose is to eliminate trust. It is hugely expensive in bandwidth, storage and computation compared to basically any other conceivable database arrangement. Rather than thinking about blockchains as a powerful technology, I think it is useful to conceptualize it as an unhelpful byproduct:

Ethereum’s blockchain is vastly more wasteful because every petty computation performed by every dApp is recorded permanently in the Ethereum blockchain. It is possible to trim these intermediate states after you have verified them but it is not possible to skip verifying them if you want to be truly trustless. That makes starting up a new Ethereum node extremely challenging. You can follow along on this thread to get a sense of the difficulty (it takes him about 25 days):

This isn’t just an esoteric concern about elegant architecture. The fact that it is so hard to run your own node means a lot of people chose not to and instead rely on third-party node services like Infura. In November of 2020 a consensus breaking bug was triggered on Ethereum that, among other things, took down the Infura Ethereum API and every Ethereum service that wasn’t running its own node abruptly collapsed. When the tide goes out you see who has been swimming naked.

A lot of things went wrong in this incident. Ethereum devs noticed this potential bug and patched it, but they never announced the vulnerability or notified key services that they needed to update their nodes. Updating an Ethereum node is a challenging and time-consuming process (see above) so many services didn’t prioritize patches unless they were security critical - which this update was not advertised as. So Infura didn’t update the nodes they were running. Finally a third group of developers (Optimism.io) working on Ethereum scaling noticed the bug and decided to trigger it in production … just to see what happened. 🤦

A common theme through all of these complaints is that Ethereum relies too much on trust and that the trust creates centralization. Users trust Infura to run honest and reliable Ethereum nodes for them, Infura trusts the Ethereum Foundation to tell them when to update those nodes, Optimism.io trusts the entire network to be resilient. But trust is antithetical to the whole purpose of cryptocurrencies.

If there is a group of trusted authorities who can be relied on to shepherd Ethereum’s destiny in good faith, why do we need a blockchain? And if there is a group of decision makers who can direct Ethereum’s destiny, how can we be sure they won’t be corrupted or co-opted in the future?

The Ethereum community’s answer would be that trustlessness is a spectrum and that the need for trust can be patched out later after the technology has been bootstrapped. The Bitcoin community’s objection would be that trustlessness is like privacy: it can only be lost, not gained.

What is Bitcoin maximalism?

The basic purpose of money is to be a convenient way to store and release value at the time and place of your choosing. That means competing types of money have very strong network effects: the more people use a kind of money the easier that money is to spend - which means it is literally better money. Just like Facebook or phone networks, cryptocurrencies get better the more people that are using them. In that sense all currencies are competing with each other, because each would grow more useful if they subsumed the other’s network.

A lot of people in the cryptocurrency space (myself included) believe that means that all cryptocurrencies are implicitly competing to become the true digital store of value. Vitalik Buterin, founder of Ethereum, coined the term Bitcoin maximalist as a derisive label for the descriptive belief that Bitcoin will inevitably eventually outcompete other cryptocurrencies. I put a some more detailed thoughts into this post from the end of 2017 but overall I hold that view.

Features are easily co-opted in the cryptocurrency space because all the tech needs to be freely available to be decentralized. What is not so easily captured is Bitcoin’s depth of liquidity, history of operation and broad and growing userbase. It is entirely conceivable to me that the next killer app will be prototyped on Ethereum. But when those use cases are ready for the big leagues I think they will graduate to the platform that has always behaved as though the stakes were high.

Then again depending on who you ask you will get different stories about how the big leagues actually feel about the two assets:

So the jury is still out, price discovery continues, we are all of us grasping about in the darkness, etc etc. One useful way to separate the market’s confidence (or doubt) about cryptocurrencies in general from their belief about Ethereum versus Bitcoin is to consider the price of ETH in terms of BTC rather than USD:

Ethereum is once again nearing all time highs in dollar terms, but in BTC terms it remains well below the peak during the ICO craze of 2017/2018. Lots of interesting experiments are happening on the Ethereum platform, but for the most part the market is still betting on Bitcoin.