Inside this issue:

A clear view is not a short distance

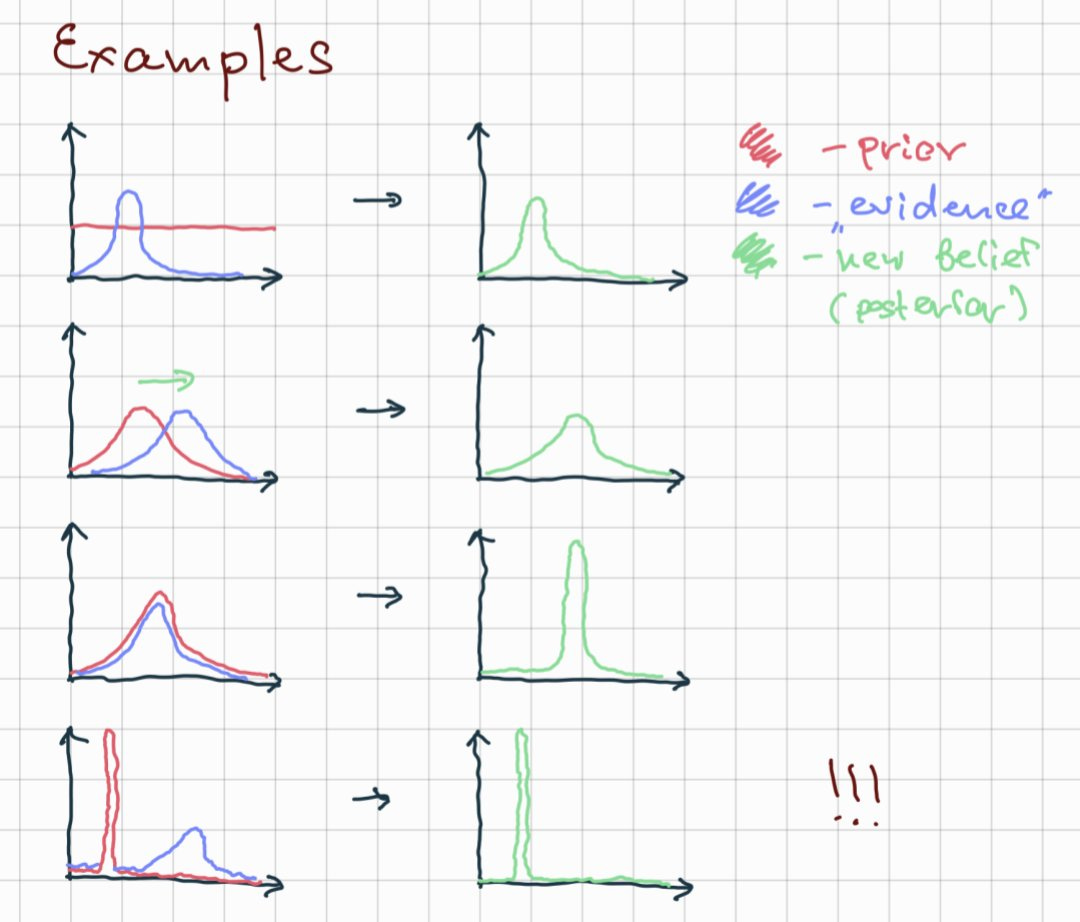

The downside risk of Bayesian priors

The Kyberswap hacker wants to steal Kyberswap itself

A clear view is not a short distance

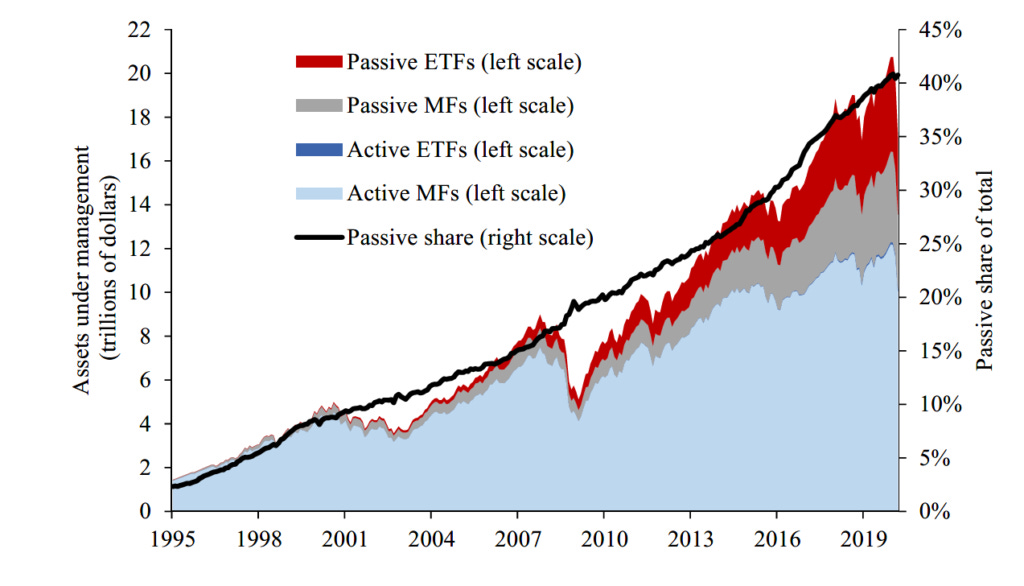

A colleague of mine who worked at Wealthfront once told me something that stuck with me: to a first approximation, no one ever changes their mind about investing. Whatever method of saving/investing they imprint on during the peak of their earnings, they basically stick with forever. He was talking about the slow migration of wealth from active to passive investing. Fees on active index funds are ~10x higher than the fees of passive funds and the overwhelming majority of them underperform the market. But passive index funds are still the minority of overall index investing today, even though the first passive index funds were introduced in 1975.

In my colleague’s view that slow trend of adoption wasn’t because investors were slowly gaining confidence in passive investing. It was because older investors were dying off and leaving their wealth to younger investors who were more receptive to the efficiency of low-cost index funds. The economy was changing its mind slowly because individual investors never changed their mind at all.

The conceptual leap from traditional financial assets to Bitcoin is, of course, much larger and more daunting than the one from active to passive investing. It makes sense that even fewer investors would be willing to cross that threshold. When I started Something Interesting (and when I joined Blockstream) my goal was to help people and companies understand Bitcoin and make that leap themselves. In retrospect, I am not sure that was ever possible to do.

Satoshi famously understood this about Bitcoin already:

"If you don't believe me or don't get it, I don't have time to try to convince you, sorry."

— Satoshi Nakamoto (2010)

It is easy to think of adopting Bitcoin as a single choice — but in reality it is the culmination of a cascade of realizations. You need to actually understand the premise (and weaknesses) of fiat currency. You need to learn to trust cryptography. You need to accept the terrifying responsibility of self custody. You need to reject the false promises of altcoin marketing. Each of these insights is independent and individually difficult and one must work through all of them to understand the value of Bitcoin.

Over the last few years my conviction about Bitcoin has not wavered, but I have substantially re-evaluated my confidence about influencing the convictions of others. People have strong beliefs about money. Strong priors aren’t easily updated.

The people who find the arguments in favor of Bitcoin convincing tend to also find them overwhelmingly convincing — which can make being a Bitcoin holder confusing and sometimes frustrating. With arguments so compelling, why aren’t people being convinced more quickly? The future is obvious! What’s taking so long?

The problem is not explaining how Bitcoin works or convincing them that it could be useful. The Bitcoin whitepaper is eight pages long and it has an established track record of making its users wealthy. The real challenge with Bitcoin is convincing people it’s worth their time to investigate. Bitcoin is a math problem that looks like a scam for internet weirdos. It’s not that it’s too difficult for people to understand. It’s too boring and cringey for them to even bother trying.

One of my biggest complaints with the fiat currency system is that the absence of good money forces everyone to be an investor — but most people don’t have the time, skill or interest in actually doing the hard work of managing investments. They don’t want to spend their days contemplating new asset classes and portfolio strategies — so they have to be judicious about what they bother paying attention to. Sticking with investments you already understand mitigates risk and requires less effort. The argument for investing in Bitcoin is strong, but the minimum effort to understand that argument is also much higher than for ordinary financial assets.

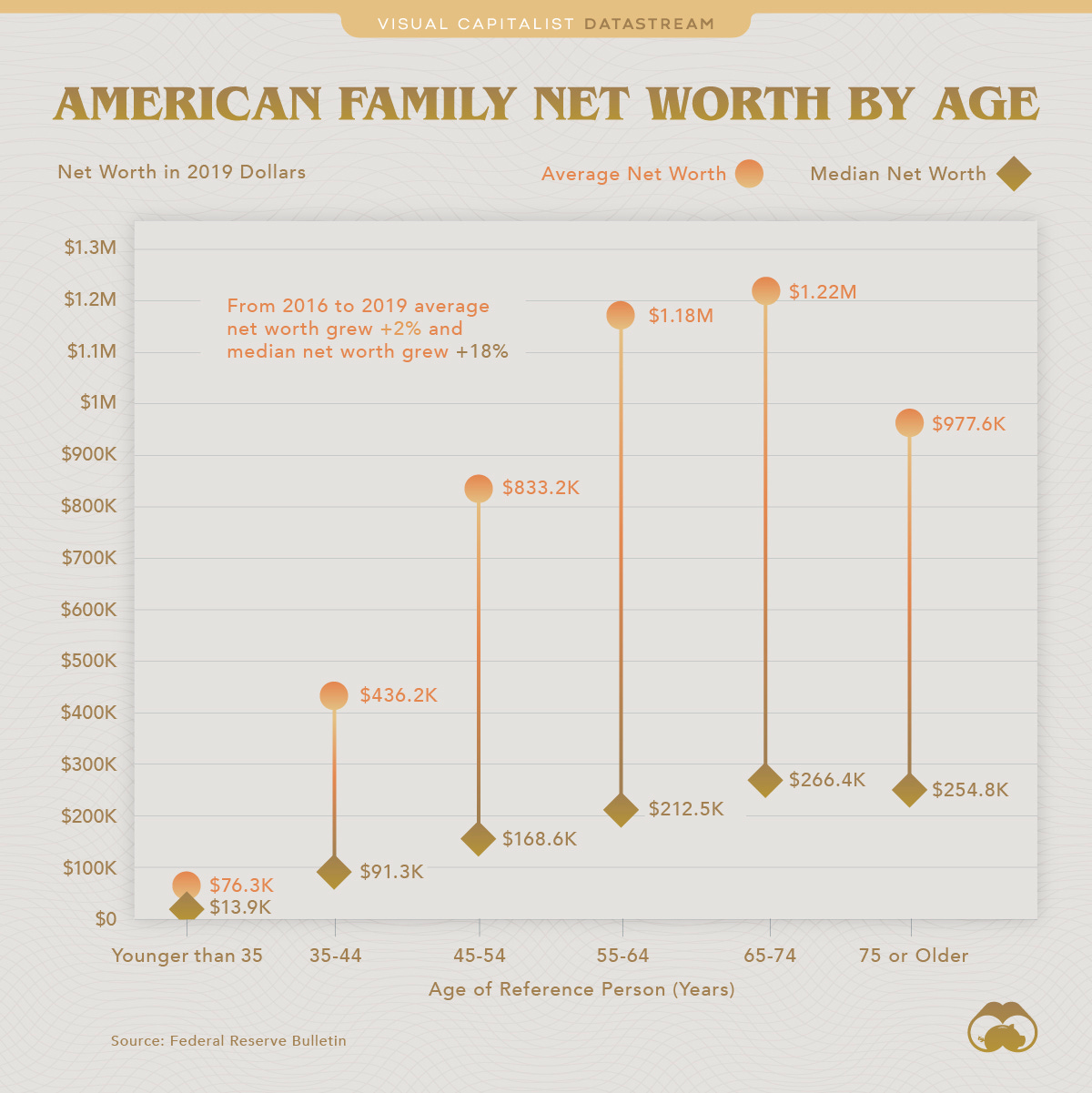

Investors in the latter stages of their investing career are especially unmotivated to explore new financial innovation. They have less time to recover from losses, so their risk appetite is generally more conservative. They also have less time to benefit from any potential upside from new opportunities. Older investors have more at risk and less to gain. It is not surprising that Bitcoin appeals more to younger investors.

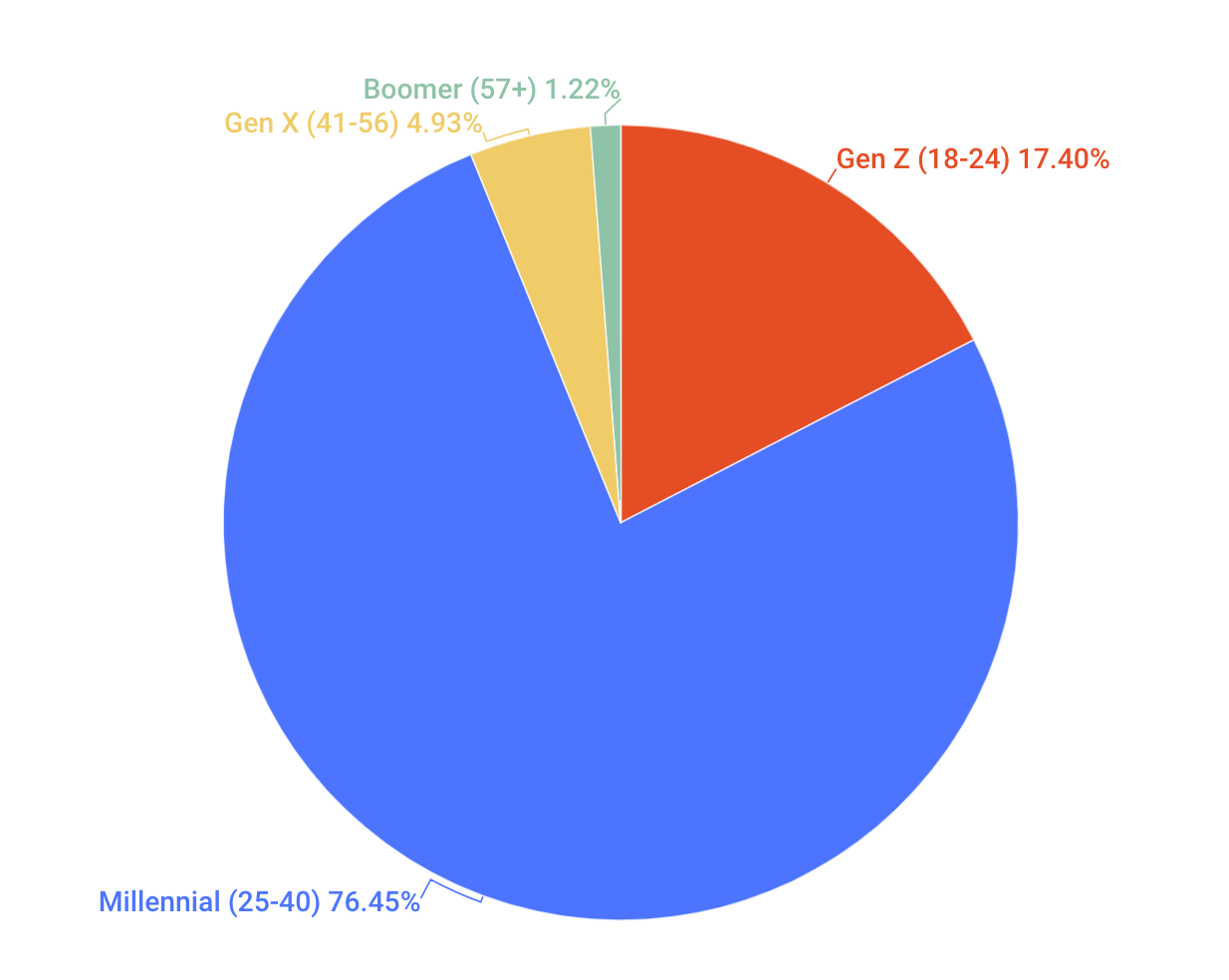

The catch is that older investors have had more time to accumulate wealth, so they tend (on average) to have more wealth to invest. Convincing one Boomer about the merits of Bitcoin will move the market about as much as convincing ~3 Millenials or around ~19 Zoomers — assuming you can convince them at all.

Anyone that changes their mind about Bitcoin has to reconcile with the idea that they could have invested sooner — the more wealth an investor had at the time, the more difficult it will be to confront that missed opportunity directly.

My sense is that fifteen years of evidence has probably convinced most of the people that are likely to be convinced. Going forward I expect more new Bitcoin investors are being born than are being converted and I suspect more wealth will move into Bitcoin through inheritance than persuasion.

Anyway, on Tuesday legendary Berkshire-Hathaway investor Charlie Munger died.

Munger was an incredible investor and an extremely sharp thinker. I strongly recommend his lecture Notes on the Psychology of Human Misjudgement, which is both entertaining and extremely useful. He was wrong about Bitcoin (in my opinion) but if I am fortunate enough to make it to 99 years old myself I have every intention of being wrong about all sorts of new-fangled young people nonsense, too. I don’t think his take on Bitcoin is an important part of his overall legacy as an investor.

But I do think Munger is a potent symbolic example of the phenomenon my colleague from Wealthfront was trying to describe. No one was ever going to persuade Charlie Munger to buy Bitcoin — but among his seven children and two step-children it seems possible that some of his wealth may find its way into Bitcoin now.

RIP Charlie Munger (1924-2023)

Other things happening right now:

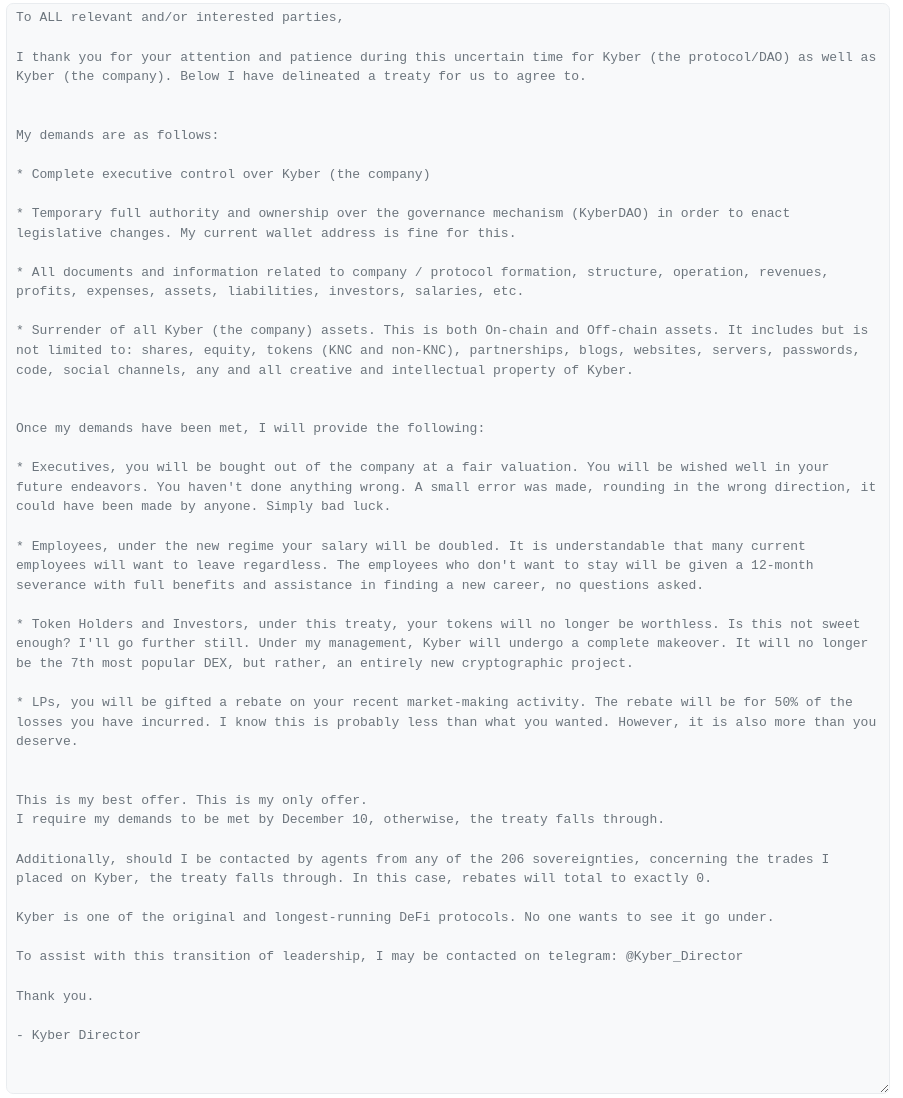

Admittedly the OpenAI debacle was pretty exciting, but when it comes to insane industry drama crypto continues to be unmatched. For example, an attacker recently stole ~$46M of various crypto assets from the Kyberswap exchange. That’s not the interesting part, obviously. The interesting part is rather than just liquidating the stolen loot the attacker is offering to ransom it back — in exchange for control of the Kyberswap exchange and the company (Kyber) that built it. They proposed a 'treaty' to compensate employees, directors and customers. Evidently they didn't think it was as interesting to steal Kyber’s assets as it would be to steal the entire business.1 Modern corporate piracy is gonna be wild:

If you prefer to consume your news lyrically, here is the Kyber story as a folk ballad.